When Nelson Madu added N5,000 (about $15 then) to the N100,000 ($300) Galaxy S4 he bought a few years back, little did he know he was protecting himself against a loss that was just days away.

About two weeks after he bought the phone, it fell from his hand and its screen crashed. He returned it to a retail outlet in Lagos where he bought it, and within 15 days, he got another new Galaxy S4—just because of the 5 per cent of the cost price he spent on insurance.

“If I had not paid that N5,000, I would have spent N200,000 within two weeks on phones and my pocket would be bleeding,” Madu, the Chief Information Officer, Information Technology & Digital Services at Coronation Insurance Plc, recalled at a webinar in August.

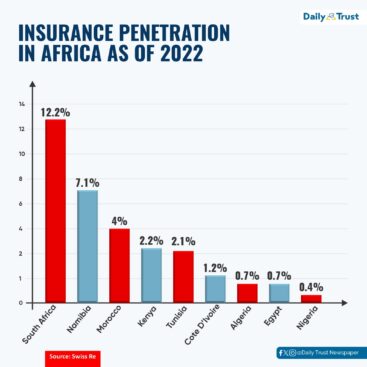

Despite some progress recorded lately, insurance penetration still remains extremely low in Nigeria, with just about 1 million out of over 200 million people insured, representing a paltry 0.5 per cent coverage.

Time and again, insurance has proved a worthy fortress for individuals and businesses to bounce back after suffering unforeseen and usually damaging losses. Yet, many are reluctant to buy it to stave off the burdens that come with such potential risks. This trend aligns with the cliche that nobody wants to buy insurance, though everybody needs it.

- Foundation partners Nasarawa govt to enrol 750 women, children into health insurance

- How to Use Insurance Add-Ons for Customized Coverage Without High Premiums

However, underwriters and insurtech companies have been innovating in recent times to change the narrative, partnering business ventures to design flexible and tailor-made insurance policies embedded in the prices of goods and services.

For instance, embedded insurance allows a retail outlet and an underwriter to work out an affordable insurance cover and integrate it into the price of an item without the buyer going through any rigorous paper work.

Catalyst for E-commerce

As the digital technology footprint expands, more businesses are going online to market their products and services. While e-commerce has become increasingly popular, trust deficits such as the ‘what I ordered versus what I got’ scenario poses a major stumbling block to attaining its full potential.

Elvis Chukwu, Chief Technology Officer at Konga Online Ltd., Nigeria, revealed that a number of people dreaded online shopping and still preferred the traditional method.

“E-commerce purchases often lead to disputes between buyers and sellers. Disputes arise from damaged goods, wrong items, or items not matching the description. Embedded insurance can provide protection and resolution for these disputes.

“Policies can offer refunds, replacements or repairs in such cases by just paying a little premium to cover that. This enhances customer trust and satisfaction. The customer will definitely be willing to buy embedded insurance at the point of checkout if they trust the platform they are buying from,” Chukwu said.

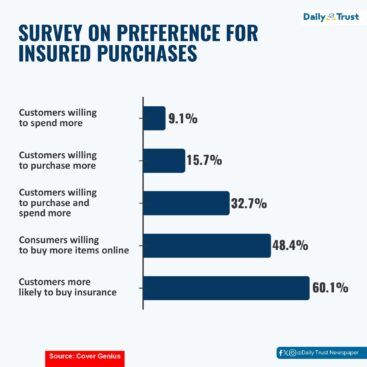

Interestingly, a survey conducted by Cover Genius, an insurtech platform, shows that if offered insurance, 9.1 per cent of customers would spend more; 15.7 per cent would purchase more; 32.7 per cent would both purchase and spend more; 48.4 per cent would be willing to buy more items online if offered insurance at checkout, while 60.1 per cent are more likely to purchase insurance from retailers who sell the products.

Embedded insurance products

Underwriters, in partnerships with insuretech companies and retail outlets, have developed quite a number of innovative embedded insurance products to entice more Nigerians to embracing insurance.

To scale up less than five per cent of Nigeria’s over 200 million population with health insurance, AXA Mansard has partnered with telecommunications giant, Airtel, by launching an insurance product embedded in the purchase of data plans.

How does it work?

Instead of buying the traditional data plan, customers can choose the data and health bundle plan together and pay via their regular Airtel airtime by dialling *141*44#. With this, Airtel customers across Nigeria can enjoy basic health insurance coverage, reaching a doctor, accessing medication worth N60,000 and a hospitalisation cover of N50,000.

“This partnership between AXA Mansard and Airtel is a milestone in providing accessible and affordable healthcare services to every Nigerian. It is the first of its kind in Nigeria, and an innovative solution that addresses the challenges of healthcare delivery in the country.

“The embedded insurance product provides coverage for basic health services and general medical consultation via WhatsApp. It is designed to make healthcare services affordable and accessible for everyone,” the insurer said in a statement announcing the product.

E-commerce outlet, Konga, has also forged a partnership with Coronation Insurance Plc to sell insurance policies together with gadgets to its vast customers. At the point of adding an iPhone to the cart, a pop-up offers a buyer an extended warranty on the phone.

“This means that we can cover you beyond what Apple guarantees,” Chukwu told Daily Trust. “We can give you an additional three years based on what the issuer (Coronation Assurance) said is possible for that product. At the point when you want to check out, you can also add the cover to the cart as an add-on, check out the two (the item and cover) together and make payment seamlessly at the same time. We also embed insurance in our services such as Konga Travels.”

Insurtech startup, Gamp, is also working with Leadway Assurance to deliver after-sales support and repair services to provide protection for individuals and businesses that buy devices.

The protection plan covers the cost of repair of damaged devices for subscribers through any of Gamp’s repair centres or Original Equipment Manufacturer accredited partners across Nigeria, allowing a subscriber to request a repair online from the comfort of their home, where the affected gadget would be picked up, repaired, and returned.

The plan can be purchased online or from partner stores and it covers all types of gadgets, regardless of brand, location of purchase, condition or model.

“This partnership is part of efforts by Leadway to expand access to insurance services by embedding them into the customer’s lifestyle. With over 130 million devices in Nigeria today, the need to provide an insurance cover to indemnify consumers against the cost of repairs cannot be overemphasised,” the Head, Partnership and Microinsurance, Leadway Holdings, Umashime Oguzor-Doghro, said.

Optimising embedded insurance

Embedded insurance requires an Application Programming Interface (API) to function optimally, bringing all the partners—seller/service provider, buyer and underwriter—together in real time to ensure seamless integration of a product or service with a relevant insurance policy and prompt activation of claims.

“API systems such as chatbots and virtual assistants offer customer support and education. Imagine a customer trying to buy a gadget on Konga at 1am when the customer care would be inactive and the customer needs to ask some questions about the benefits of buying insurance with the item. The [chatbot] response can convince the customer to buy insurance,” Chukwu remarked.

With a functional API informed by robust data, Madu said customers could access insurance covers alongside goods or services in three to four clicks, thereby eliminating the bureaucratic process of buying policies and making claims.

“Data is critical in technology and with data, a lot of insights can be gained. Data management has become a significant part of the insurance process. It enables insurance companies to determine the personalised products for their different customers,” he added.

The Chief Operating Officer of an insurtech firm, PaddyCover, Opeoluwa Duntoye, noted that embedded insurance has huge potential at driving insurance uptake in Nigeria if a lot of businesses could be digitised.

“Over time, we have realised there is a need for a lot of education, simplifying the process and making it digitised so that anybody can buy insurance anywhere they are,” she added.

Erika Krizsan, a leading expert in insurance innovation and digital transformation also emphasised the need for awareness creation to expand the frontiers of embedded insurance and insurance in general.

“It is a big advantage for the industry if they can harness technology and talents. Every company has to embrace embedded insurance. We have the technology, but without educating the people, there won’t be an opportunity to use embedded insurance,” said Krizsan, the Managing Director, InTa Innovation Education.

Indeed, some comments under the statement posted on the AXA Mansard website on the embedded health insurance plan reinforced the need for increased awareness.

One commenter, Ezekiel Iyamu, curiously asked, “Can we get the comprehensive terms and conditions for the Airtel policy and also the full list of benefits compared to the regular plan?”

“Yes, please, I’ve been looking all over for a full list of benefits as well as terms and conditions. The information available is too shallow. The idea seems interesting and innovative though,” one Victor Zack also commented.

Increased uptake amid more potential

PaddyCover’s Duntoye strongly believes that embedded insurance holds the key to increasing insurance penetration in Nigeria, where a lot of people hardly buy insurance of their own volition. With the emerging market, it is now easy for them to make that buying decision when they are being met at their point of need, she told Daily Trust.

“80% of our customers are people who have never experienced any insurance before. Probably what they had bought before is third party [insurance] because it is compulsory. One of the scariest things for them is they don’t have the huge lump sum to pay as insurance.

“We have a lot of business owners that come into our platform, and because they are able to pay monthly or quarterly, they have a flexible payment option, which gives them an option to spread their payments and manage their cash flows.

“We have logistics companies partnering with us. As they are taking customers’ goods, they know they (the customers) are covered. It is easy for them to onboard these customers who are delighted that insurance is already embedded because they don’t want to do paper work. We have been able to tie our technology infrastructure around that, making it seamless. We partner with a lot of underwriters to make our customers have holistic offerings,” Duntoye revealed.

She further explained that embedded insurance had reached the next level at PaddyCover, with the company’s partners now using insurance as a reward for their customers.

“We have a partner that does solar panels and supplies basically to rural areas. A lot of people in the rural areas our partner supplies don’t have access to healthcare. They travel long distances before they can access healthcare. But because they are loyal customers, our partner has embedded health insurance as a reward system for buying the solar panels.

“They can now talk to doctors from our platform. They have been integrated with us. The partner pays for it (insurance) and those people are able to access healthcare. They don’t have to be looking for money to buy malaria drugs because the company has already taken care of that,” Duntoye added.

The Chief Executive Officer at Coronation Insurance Plc, Olamide Olajolo, observed that embedded insurance is “revolutionalising” how underwriters and businesses engage clients, manage risks and streamline operations, adding that “the opportunities are limitless when it comes to embedded insurance. In every sphere of our lives, we can have embedded insurance: housing, electronics, travel, health, etc.”

Olajolo said the National Insurance Commission (NAICOM) had been supportive in driving embedded insurance in Nigeria through engagements with underwriters.

“You just have to engage them. The first mandate of NAICOM is to protect policy holders. So you need to take them through the process: the purchase of the insurance products, how the customers will make claims, among others.

“There is a trust issue when it comes to insurance in Nigeria and the only way NAICOM can take care of that is to ensure customers are protected when they know the end-to-end process, which involves the purchase of the product, onboarding and timely payment of claims. NAICOM is at the forefront of embedded insurance to deepen insurance penetration,” he stated.

Poverty not an excuse

Embedded insurance could be erroneously seen as an additional burden in a galloping inflationary economy like Nigeria with high poverty, but the Chief Executive Officer, Nigerian Council of Registered Insurance Brokers (NCRIB), Tope Daramola, insisted that its benefits far outweighed the perceived burden.

“Where we miss it is the fact that whatever is worth having is worth insuring. Embedded insurance will be very good for products like smartphones. The least one spends to buy a phone now is N100,000 to N150,000. If you have insurance attached to it, when it gets lost, for somebody who is already battling with lack, how do you replace it? But if it is insured, the insurance company indemnifies you.

“Industry operators need to enlighten the people more. When there is ignorance, people don’t really understand what benefits they would get from such insurance. It’s a lovely idea and one of the ways to reflate the contributions of insurance to the national economy and buoyancy of the industry itself,” he said.