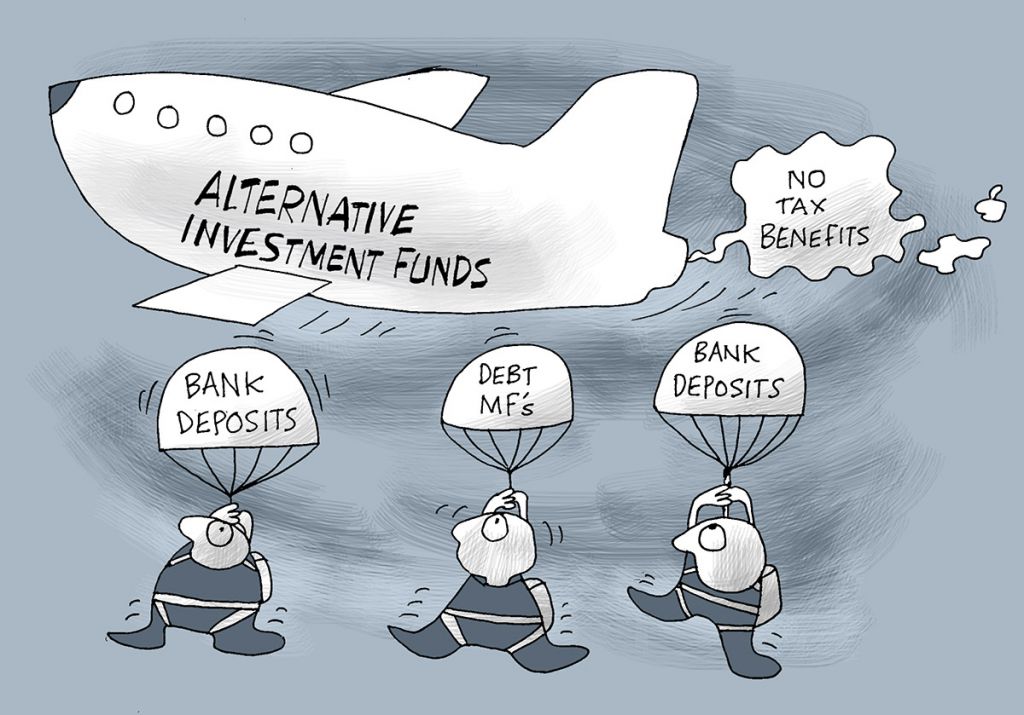

Around Rs 1 trillion, or a fifth of the investments made by alternative investment funds (AIFs) are questionable in terms of the intent behind the investments and are under the scanner for circumvention of regulations, said Ananth Narayan, whole-time member of Securities and Exchange Board of India (Sebi).AIFs are pooled investment vehicles that invest in a variety of assets including real estate, startups, unlisted companies, and derivative strategies in the listed space.