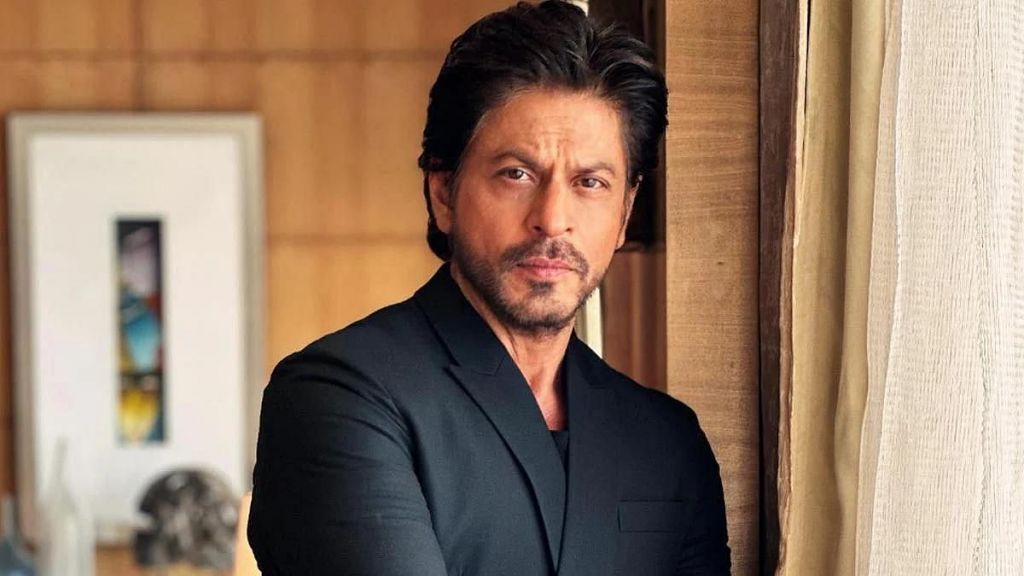

The Income Tax Appellate Tribunal (ITAT) has given relief to actor Shah Rukh Khan by quashing a reassessment order issued for allegedly not paying tax in India on remuneration for the film ‘Ra.one’

The case pertains to Assessment Year 2012-13 when Shah Rukh Khan filed an original Income Tax Return showing an income of over Rs 83.42 crore.

About A Previous Ruling

Earlier in 2017, ITAT had ruled that the actor has to include notional rent from his Dubai villa in his income-tax return filed in India. Khan had submitted to the ITAT that under the India-UAE tax treaty, income from immovable property in Dubai would be liable to tax in the UAE and, therefore, he had not offered it to be taxed in India.

The ITR was selected for scrutiny and notices along with a questionnaire were issued based on the actor's response the Assessment Officer (AO) in March 2015 passed the order and assessed the total income of the assessee at Rs 84,17,99,923 ( over ₹84.17 crore), after making certain additions/disallowances.

The Assessment Officer initiating the re-assessment proceedings recorded various reasons including Red Chillies Entertainment (in which Khan is a director and holds half of the shares) has paid artiste remuneration to Khan Rs 10 crore for the film ‘Ra.one’ was routed through Winford Production (UK- based line producer).

About The Case

The production house Red Chillies paid Rs 10 crore to UK-based company after deducting TDS of Rs 1 crore. The UK-based company deducted Rs 1.40 crore as FEU (UK Tax Deduction) and finally paid ₹7.6 crore to Khan. “The assessee offered this amount as income earned in the UK and paid additional tax in the UK of Rs 2,70,17,977. This is evident that such an arrangement of payment has caused revenue loss to the government of India,” AO recorded.

The ITAT bench observed there were neither any fresh facts nor some information with regard to the facts previously disclosed, which came to the possession of the AO after the conclusion of the scrutiny assessment proceedings and quashed the notice and orders against the Bollywood Badshah.

The tribunal held that after the expiry of four years from the end of the relevant assessment year, notices were issued by the income tax officer to reassess the taxpayer’s ITR claiming disagreement with the actors assessment income were not been properly assessed issuing orders in March 2019. The Bollywood superstar replying to the IT notices had completely denied the assessment officers claims.