The Sagility India shares skyrockets by almost 10 per cent on NSE, after company declared their quaterly results for Julu- September quarter of fiscal year 2024-2025, revealing a massive jump of 235.6 per cent in the PAT (profit after tax).

The shares of Sagility India touched a day high level of Rs 31.54 per share on the NSE (National Stock Exchange), after hitting th opening bell at Rs 30.30 per share on the bourses.

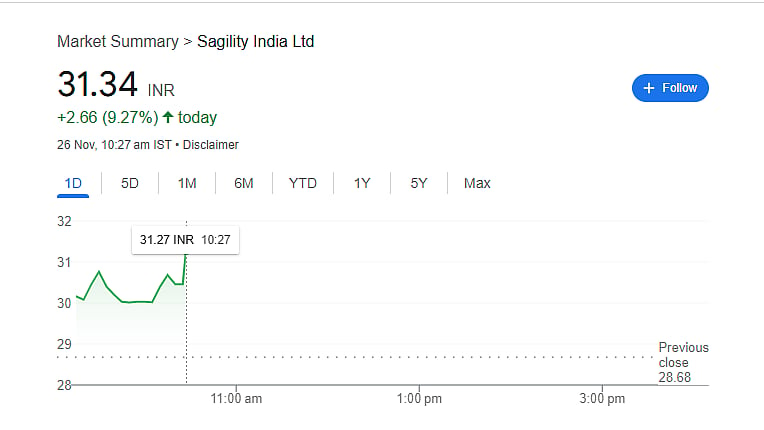

Sagility India's shares were trading around Rs 31.34 per share on the NSE (National Stock Exchange) with a jump of 9.27 per cent amounting to a Rs 2.66 per share on the bourses.

Sagility India Q2 FY25

During the three months that ended in September 2024, Sagility India's consolidated net profit increased by 235.6 per cent to Rs 117.34 crore. The post-tax profit for the previous year was Rs 34.96 crore.

Compared to Rs 1,094.1 crore in the same period last fiscal year, revenue from operations climbed 21.1 per cent to Rs 1,325 crore in the reviewed quarter.

Sagility India IPO

On Tuesday, November 12, Sagility India's shares made a quiet market debut, listing at Rs 31.06 on the NSE and BSE, 3.53 per cent higher than the issue price of Rs 30.

The Rs 2,106.60 crore initial public offering (IPO) of Sagility India was available for subscription between November 5 and November 7. The price of each share in the public offering was between Rs 28 and Rs 30.

Sagility IPO closed with strong demand after three days of bidding, receiving 3.2 times bids. Out of the 38.7 crore shares available, 123.99 crore shares were bid on during the IPO.

There was no fresh issue component to the Sagility IPO; it was solely an offer for sale (OFS) of 70.22 crore shares. Promoter ownership of the business will drop to 82.5 per cent after the problem. Anchor investors contributed Rs 945.40 crore to the company on November 4, 2024. Retail investors could apply with a minimum investment of Rs 15,000 and a minimum lot size of 500 shares.