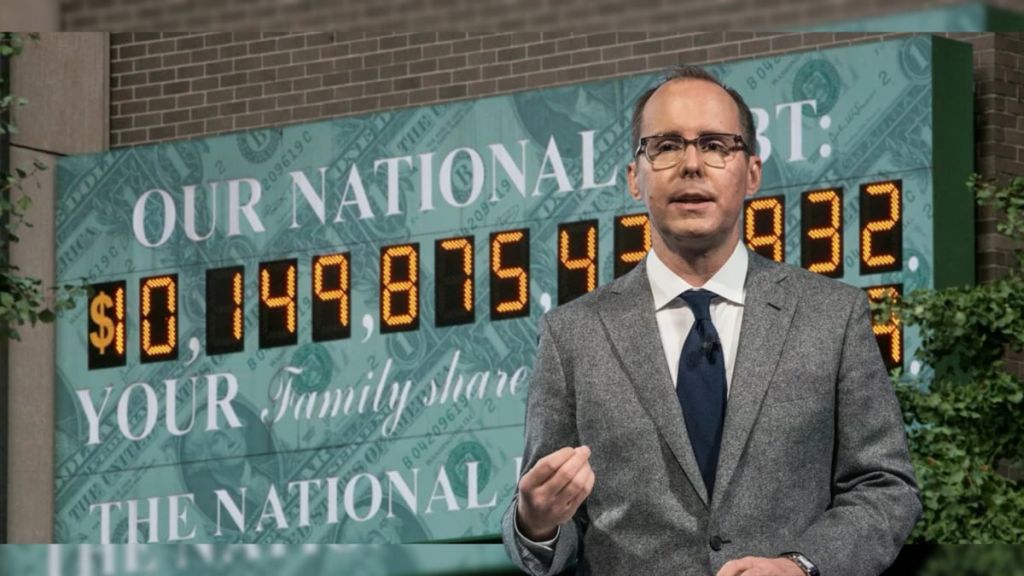

The US national debt, which stands above USD 34 trillion, is about 123 per cent of the world's largest economy's Gross Domestic Product, or GDP. The US GDP is at USD 29.17 trillion.

Will The Debt Explode?

For context, India, which according to the IMF, is the 5th largest economy has a total national debt of USD 2.9 trillion, which is about 56 per cent of the country's GDP, which in pursuance to the IMF stands at USD 3.89 trillion.

When it comes to the US, this aforementioned number of the national debt has been a hot topic of discourse and has remained a mainstay in the socioeconomic and larger political conversations in the US for many election cycles.

Many have raised alarm about the country's national debt and how it would result in ramifications that not everyone may be prepared for.

Spitznagel's Prediction

Adding to these concerns, renowned bearish investor, Mark Spitznagel has once again predicted a market crash, that according to him will result in the indices and stocks losing half their value. This, according to Spitznagel, would come to pass as result of a massive sell-off, that eventually percolates into the economy, and drag it down into a period of recession.

One of the sticking points for Spitznagel is the country's national debt, which could lead to an implosion so significant that even the Federal Reserve would not be able to gird the loins and churn something constructive quickly.

Previous Predictions

It needs to be noted, that this is not the first, either Spitznagel or other forces in the market have predicted crash and a recession in the US. Previously, as the world emerged from the pandemic in late 2022 and early 2023, till late 2023, there were predictions of the US economy entering recession in 2024.

However that did not come to pass, in fact, the US exhibited the strongest growth amongst the developed economies. However, its peers around, may it be in Europe or its biggest rival, China have underperformed.

What comes to pass in the United States is crucial to the world at large, given have influential its role is, in the context of the international markets and the world economy at large.

In the past 6 months, the Dow Jones has gained 13.38 per cent of its value, reaching 44,296.51 points. The S&P 500 has gained 12.53 per cent, jumping to 5,969.34 points. Meanwhile, tech-heavy Nasdaq has risen by 12.31 per cent in the 6 month period, scaling to 19,003.65 points.