Last Week Today

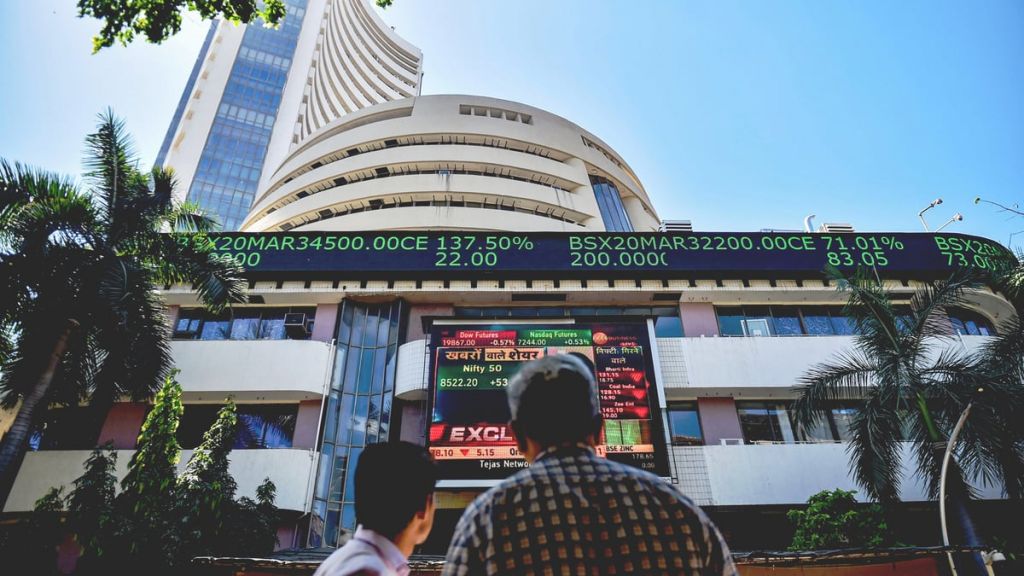

Friday’s gain has helped Dalal Street turn positive for the Nifty with the Sensex and the Nifty snapping the two-week losing streak, regaining half of last week’s losses. But there are too many variables, especially from the global side, which make it harder to say whether this is it or there is some more pain left.

Going through the week, the Indian benchmark indices continued to be volatile during the truncated trading week and traded in the band of 23,263-23,900, nearly 640 points. As discussed last week, with the second quarter earnings ending, investors turned their attention to global and domestic factors, which weighed on investor sentiment.

At the beginning of the week, equity benchmark indices ended with marginal gains after experiencing their longest consecutive losing streak since February 2023. However, both the Sensex and Nifty had dropped nearly 1,000 points and 300 points, respectively, from their intra-day highs in the final hour of trading, following reports of escalating geopolitical tensions between Russia and Ukraine.

This news came in the wake of Joe Biden’s decision to authorise Ukraine’s President to target military sites in Russia using U.S.-made long-range weapons. As a result, this adversely affected the global markets, including India.

During mid-week, we saw Nifty also closing below the 23,400 mark due to a sharp decline in Adani Group stocks on the news of the USD 250 million bribery and continued selling by foreign institutional investors.

Additionally, geopolitical tensions, as already discussed above, along with weak global markets following muted earnings guidance from chipmaker Nvidia, added some fuel to the negative news.

We believe the market is expected to be sector- and stock-specific, with any significant declines presenting good buying opportunities.

With this, let me present to you our weekly portfolio review.

How Did the Markets Fare Last Week?

On a weekly basis, which ended on Friday, the Indian benchmark indices ended in green. Sensex and Nifty were up between 1.6 per cent and 2.0 per cent, while Midcaps were up 1.7 per cent.

Crude and FII Flows

Brent crude oil prices traded around USD 74/bbl as traders weighed escalating geopolitical risks against signs of increasing inventories in the US, the biggest consumer. On the other hand, FIIs continue to be net sellers for the week.

Sector in Focus

Realty, auto, and metals remained in focus during the week.

Mahindra & Mahindra: TECHNICAL BUY CALL OF THE DAY

Price is on the verge of breaking out from a double bottom pattern on the daily chart.

Buying was visible across the Auto space, which may support the upmove. The RSI indicator is rising, which confirms the bullish momentum.

Buy Mahindra & Mahindra CMP 3012 SL 2920 TGT 3220

Stocks That Made Headlines During The Week

Adani Group Stocks in Focus:

Adani Group’s renewable units scrapped a USD 600 million bond offering after US prosecutors charged Gautam Adani, the group founder, for USD 250 million with participating in an alleged bribe plot

Paytm:

The company has launched UPI International, allowing Indian travellers to make Unified Payments Interface (UPI) transactions at select global locations. This feature enables users to make cashless payments using the Paytm app in the UAE, France, Mauritius, Singapore, Bhutan, and Nepal.

Tata Power:

The company entered into a strategic partnership with Druk Green Power Corpo, a subsidiary of Druk Holding and Investments Ltd., the sole generation utility of Bhutan, to collaborate and develop at least 5,000 MW of clean energy generation capacity in Bhutan.

State Bank of India:

The bank has raised Rs 10,000 crore through 15-year infrastructure bonds at a coupon rate of 7.23%, taking the total money raised through these long-tenor papers to Rs 30,000 crore in FY25, said multiple sources aware of the development. Further, Finance Minister Nirmala Sitharaman said SBI will open another 500 branches to take its overall network to 23,000 by the end of FY25.

SJVN:

SJVN has signed a Memorandum of Understanding (MoU) with the Energy Department, Government of Rajasthan, to spearhead the development of renewable energy in the state. Under the MoU, SJVN would develop 5 GW of pumped storage projects and 2 GW of floating solar projects in the state. Both parties have agreed to collaborate for the development of renewable energy on a long-term basis.

Protean eGov:

According to a press release, NSE Investments is set to divest up to 20.31 per cent of its stake in Mumbai-based e-governance solutions provider, Protean eGov Technologies, through an offer for sale (OFS).

The OFS will consist of a base issue of 10.16 per cent equity, with a green shoe option for an additional 10.16 per cent equity. The floor price for the issue is set at Rs 1,550 per share, a discount of close to 19 per cent from Thursday's closing price of Rs 1,849.75 per share.

The OFS opened on 22nd November for non-retail investors and for retail investors on 25th November 2024.

PSP Projects:

PSP Projects said in a press release that Adani Group firm Adani Infrastructure will acquire a 30.07 per cent stake in it from one of its founders for Rs 685 crore. Promoter Prahaladbhai S. Patel is the seller who entered into a share purchase agreement with Adani Infra (India) Limited by selling 1.19 crore equity shares representing up to 30.07% of the paid-up equity share capital of the PSP Projects.

Dr. Reddy's:

The company has informed exchanges that the United States Food & Drug Administration (USFDA) completed a GMP inspection at our API manufacturing facility (CTO-2) in Bollaram, Hyderabad. The inspection was conducted from November 13th, 2024, to November 19th, 2024. Dr. Reddy's has been issued a Form 483 with 7 observations, which they will address within the stipulated timeline.

Garden Reach Shipbuilders:

In a display of its capability to build new-age vessels and contribute towards a greener future, Garden Reach Shipbuilders signed a contract with the Transport Department, Government of West Bengal, for the delivery of 13 hybrid ferries. The ferries will be operated on the River Hooghly by the West Bengal Transport Infrastructure Development Corporation Ltd. (WBTIDCL).

GMR Airports:

The company has released its monthly data for October 2024, wherein it handled more than 10.7 million passengers across all airports, reflecting a growth of 9.2 per cent YoY, including both domestic and international traffic. Interestingly, the passenger traffic is transcending sustainably above 10 million passengers every month since Dec’23.

Disclaimer: The Free Press Journal assumes no liability for loss or damage, including, but not limited to, lost profits, that may result directly or indirectly from the use or reliance on the opinions, news, investigations, analyses, prices or other information offered in this article.