The books define a Real Estate Investment Trust (REIT) as a company that owns and manages income-producing real estate. We call them the mutual funds of the real estate world. They pool capital from multiple investors, invest in properties, and provide regular dividends. While they typically cover all property types, REITs in India focus on commercial developments and are listed publicly on stock exchanges. You could be a working professional, a retiree or a savvy investor.

India’s real estate sector is set to account for 13% of the total GDP in 2025 and is the country's second-largest source of employment. REITs allow investors to benefit from this massive potential without actually owning or managing a property themselves. Take a detailed look at Real Estate Investment Trusts in this article. From ways of investment to top players, find out everything you need to know to start making money from real estate today!

How Do REITs Function?

Real Estate Investment Trusts in India are regulated by SEBI (Securities and Exchange Board of India) under the SEBI (REIT) Regulations, 2014. These companies pool capital from multiple investors to create a diverse portfolio of capital-generating properties, like offices, shopping malls, warehouses, etc. 80% of Indian REITs’ assets must be in completed and revenue-generating properties. The remaining 20% can be allocated to under-construction projects, bonds, or cash reserves. REITs make money primarily by renting and leasing these properties. The revenue earned is then distributed to investors through dividends, interests and capital gains.

For instance, Bangalore emerged as the top contributor to India’s REIT-based office market in 2023, with a contribution of 31%. A strong demand for Grade A offices in IT hubs like Whitefield and Outer Ring Road drove the growth. Now, a tech firm looking to expand in one such area can comfortably lease multiple floors in a REIT-owned commercial tower. This can help capitalise on Bangalore’s REIT boom and directly fuel returns to investors.

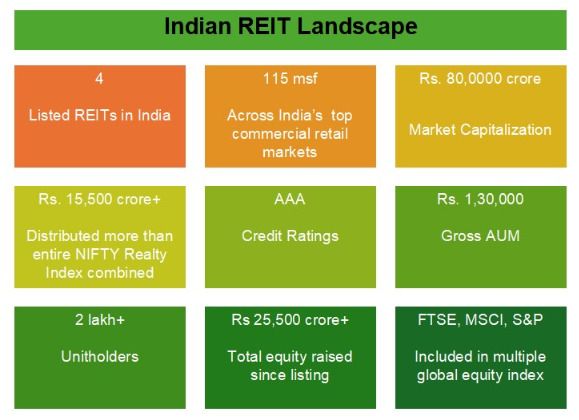

SEBI requires REITs to distribute at least 90% of their net distributable income to investors. As publicly listed, the Development and growth of the REIT in India are overseen by the Indian REIT Association (IRA). India today has four publicly listed REITs, namely:-

● Embassy Office Park REIT (2019)

● Mindspace Business Parks REIT (2020)

● Brookfield India Real Estate Trust (2021)

● Nexus Select Trust (2023)

Source: Indian Brand Equity Foundation

How to Invest in REIT?

While traditional real estate investments, say buying a flat in Bangalore, are expensive and tedious, REIT investments are simple. Investors can easily buy REIT units via:

1) Stocks - The most direct way to invest in REITs is by purchasing units listed on the National Stock Exchange and/or Bombay Stock Exchange. A Demat account is mandatory for investing in REITs via stock exchanges.

2) Mutual Funds: Investors can also invest in REIT-focused mutual funds directly through mutual fund platforms, banks, or AMCs. It offers indirect ownership and portfolio diversification without the need for a Demat account.

3) Exchange Traded Funds (ETFs): While not currently available in India, REIT investments are also made through ETFs worldwide. These also provide indirect ownership and require a Demat account.

Types of REITs

REIT investors get a wide range of options to choose from based on their liquidity, income generation and risk preferences. Some popular types of REITs in India include:

Equity

The most popular type of REITs, these companies own and manage income-generating commercial properties, such as shopping malls, apartments, office buildings, etc. Rental and lease proceeds, thus earned, are distributed among shareholders as dividends.

Mortgage (mREIT)

Mortgage REITs earn money by lending funds to real estate companies, extending loans and acquiring mortgage securities. Revenue is, thus, generated in the form of interest payments. Any fluctuation in the interest rate will likely impact profit made through mREITs.

Hybrid

Hybrid REITs juggle between equity and mortgage options. They invest in physical properties as well as mortgage securities. The revenue is generated in the form of rent and interest. Hybrid REITs offer diversification, reducing vulnerability to fluctuations in a single sector.

Publicly Traded

These include Real Estate Investment Trusts listed on the National Stock Exchange and registered with SEBI. These can be easily traded via the stock exchange.

Privately Traded

Private REITs are available only for select investors. These are neither listed on stock exchanges nor registered with SEBI. Private REITs typically have low liquidity.

Public Non-Traded

REITs registered with SEBI but not listed on any stock exchange are classified as public non-traded REITs. They are sold and purchased directly via the trust. These cannot be traded online. Public non-traded REITs are also less vulnerable to market fluctuations.

Advantages of REITs:

Investing in Real Estate Investment Trusts offers advantages like:

● Ease of purchase and sale.

● High portfolio diversification with better exposure and risk mitigation.

● Requires less capital than actually purchasing a property.

● Provides a steady source of secondary income to investors.

● SEBI’s regulation ensures transparency and accountability.

Disadvantages of REITs:

Here are some prominent drawbacks of investing in REITs in India:

● India currently has only four publicly listed REITs.

● Taxes on gains deduct a significant portion of the investor’s earnings.

● Prices of REITs are subject to fluctuations in the market.

● Indian REITs offer limited exposure to residential investments.

● Fluctuations in rental earnings directly impact dividend payouts.

Tips for Choosing the Right REIT

Like any investment, REITs are also a game of discerning choices. Investors must consider the following things before investing in a Real Estate Investment Trust:

Tax Implications: Income earned from REITs is taxable. While dividends are taxed in the investor’s hand, capital gains are subject to Short-Term and Long-Term Capital Gains (STCG/LTCG) tax slabs in India.

Purpose of Investment: Dividends suit traditional investors looking for regular and steady secondary income. In contrast, high-risk investors prefer capital appreciation benefits earned over a long period of time.

Past Performance: Evaluating a REIT’s past performance helps assess its profitability. Key factors to consider include occupancy rates, Net Operating Income (NOI), and dividend yields.

Choose Diversified Portfolios: Real Estate Investment Trusts with diverse properties offer better risk mitigation. A portfolio spread across residential, commercial, logistic and other sectors is typically less vulnerable to fluctuations in a single industry.

Quick Takeaways

Property ownership has been the gold standard for earning passive income in India for decades. The introduction and rapid expansion of Real Estate Investment Trusts have changed that. It has presented an alternative to property ownership and introduced a new way of creating wealth.

Today, REITs comprise 13.7% of India’s total listed real estate. The ICRA has already forecasted a strong 6-6.5x expansion of REIT-office supply in the country. As this new asset class rises its crescendo, it poses thriving opportunities for all stakeholders - the buyers, the builders and the property managers.