Prices and rents will fall under Rachel Reeves’ plans, enabling a younger generation with new ideas to enter the field

One of the baleful dimensions of our times is the way that the conversation about what constitutes the good society is framed by the rich and their interests. A conception of the common good withers; instead it is replaced by the existential importance of private wealth, private interests and private ownership to societal health. Nowhere is this more exposed than in the debate over taxation, and in particular the taxation of inherited wealth – as the debate over the past fortnight has dramatised.

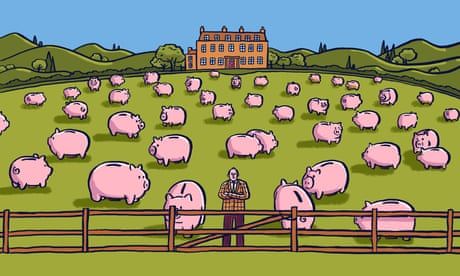

Half a million people die every year. Under the reforms to inheritance tax relief on agricultural land proposed in the budget, about 500 individuals who inherit land worth more than £2m (£3m if they were married to the deceased) will join the rest of society and have inheritance tax levied on their bequest – albeit at half the rate, with an enlarged exemption and 10 years to pay it, concessions not made to the rest of us. How fortunate and privileged are they?

Continue reading...