Gold loans are a popular borrowing option in India, providing quick access to funds by pledging gold as collateral. While the process of obtaining a gold loan is relatively straightforward, understanding how interest rates are calculated is vital for making informed decisions.

This article explains the key factors influencing gold loan interest rates and how to estimate the costs involved.

Factors Influencing Gold Loan Interest Rates

Gold loan interest rates are determined by various factors. Knowing these can help borrowers negotiate better terms.

1. Loan-to-value (LTV) Ratio

The Reserve Bank of India (RBI) allows lenders to offer gold loans up to 75% of the gold’s current market value. Borrowers opting for higher LTVs may face slightly higher interest rates, as the risk to the lender increases.

2. Purity and Weight of Gold

The interest rate is influenced by the quality and quantity of the gold pledged. Most lenders accept gold of 18 to 24 karats. Higher purity gold fetches better value, potentially leading to favourable interest rates.

3. Loan Amount

Larger loan amounts may come with lower interest rates, as lenders often offer tiered rates based on the loan quantum. Smaller loans may attract slightly higher rates due to administrative costs.

4. Loan Tenure

Shorter loan tenures often come with lower interest rates, as lenders face reduced risk over a shorter repayment period. Conversely, longer tenures may have higher rates.

5. Market Trends

Interest rates can fluctuate based on economic factors like inflation, the RBI’s monetary policy, and market demand for gold loans

6. Borrower’s Profile

Your credit history and repayment capacity can influence the rate offered. While gold loans rely primarily on the pledged asset, a good financial track record may help secure better terms.

How is the Gold Loan Interest Rate Determined?

The interest rate on a gold loan is calculated based on several influencing factors, each contributing to the lender’s assessment of risk and market conditions.

Here are the key components involved in calculating the interest rate:

1. Benchmark Lending Rate (BLR)

Lenders typically start with a benchmark lending rate, which acts as the base rate for all loan products. This rate is influenced by the Reserve Bank of India’s policies, such as the repo rate, and broader economic conditions.

2. Risk Premium

Gold loans are secured loans, which reduces the lender’s risk compared to unsecured loans. However, factors such as:

- Fluctuations in gold prices,

- Borrower’s repayment history, and

- Market demand for loans

contribute to the risk premium added to the BLR.

3. Loan Tenure Adjustment

Shorter tenures often attract lower rates due to reduced risk exposure. For longer tenures, lenders may add a small premium to cover uncertainties over time.

4. Administrative Costs

To cover operational costs like loan processing, verification, and gold storage, lenders may include a marginal administrative fee in the effective interest rate

5. Loan Amount and LTV Ratio

The ratio of the loan amount to the pledged gold’s value (LTV ratio) can also influence the rate. Borrowers opting for a higher LTV ratio may face a slightly higher interest rate as the lender’s risk increases.

Mathematical Example of Interest Rate Calculation

Let’s assume a gold loan with the following details:

- Benchmark Lending Rate (BLR): 7%

- Risk Premium: 3%

- Administrative Cost: 2%

Final Interest Rate: BLR + Risk Premium + Administrative Cost = 12% per annum

This is how lenders arrive at the annual interest rate for the gold loan. Borrowers can use this understanding to negotiate and choose loans with transparent and minimal additional costs.

How to Calculate Gold Loan Interest Costs

Calculating the interest rate on a gold loan involves understanding the repayment structure. Here’s a step-by-step guide:

1. Know the Principal Amount

The principal amount is the loan amount sanctioned by the lender based on the gold’s value. For example, if you pledge gold worth ₹5,00,000 and the lender offers an LTV of 70%, the principal amount will be ₹3,50,000.

2. Understand the Interest Rate Offered

The interest rate could range between 7% and 29% per annum, depending on the factors mentioned above. Let’s assume a rate of 12% for this calculation.

3. Choose the Repayment Option

Gold loans often provide flexible repayment methods:

- EMI-based repayment

Fixed monthly payments including principal and interest.

- Interest-only payments

Regular interest payments during the tenure, with the principal repaid at the end

- Bullet repayment

Both principal and interest are paid in a lump sum at the end of the loan term

Lets calculate this example to understand how to calculate the final EMI

Example Calculation

Let’s take a hypothetical example:

- Loan amount: ₹2,00,000

- Interest rate: 12% per annum

- Tenure: 12 months

- Repayment method: EMI

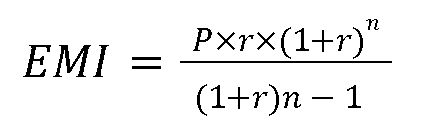

Using the formula for EMI:

Where:

- P = Principal amount (₹2,00,000)

- r = Monthly interest rate (12% ÷ 12 = 1% or 0.01)

- n = Number of months (12)

The EMI for this loan would be approximately ₹17,916. Over 12 months, the total repayment amount will be ₹2,14,992, including ₹14,992 as interest.

4. Use a Gold Interest Calculator

A gold interest calculator simplifies this process. It allows you to input details like the loan amount, interest rate, and tenure to estimate monthly payments or the total repayment amount. Tools like the one available on Bajaj Markets can be helpful for this.

Tips to Minimise Gold Loan Interest Costs

- Compare Lenders

Research multiple lenders to find the best interest rates and repayment terms

- Opt for Shorter Tenures

Choosing a shorter repayment period reduces overall interest costs

- Negotiate

Borrowers with good credit scores or large loan amounts can negotiate better rates

- Use Online Calculators

Tools like the gold interest calculator provide clarity on repayment obligations before applying

- Regular Repayments

Timely repayments prevent penalties and keep interest costs under control

Common Queries About Gold Loan Interest Rates

How is the interest calculated on a gold loan?

Interest is calculated based on the principal amount, interest rate, and tenure. Repayment methods like EMI or bullet payments can affect the overall cost.

Can I get a fixed or floating interest rate on a gold loan?

Gold loans usually come with fixed interest rates, ensuring predictable repayments. However, some lenders may offer floating rates.

Do gold loan interest rates differ across banks and NBFCs?

Yes, rates vary depending on the lender’s policies. Banks may offer lower rates, but NBFCs often provide more flexible terms.

Are gold loan interest rates negotiable?

Borrowers with a good financial profile or those seeking larger loans may negotiate lower rates with lenders.

How does gold loan tenure affect interest rates?

Shorter tenures usually come with lower interest rates, as the lender’s risk exposure is reduced.

Making Informed Decisions

Understanding how gold loan interest rates are calculated helps borrowers choose the most cost-effective options. By evaluating factors like LTV, tenure, and repayment methods, borrowers can plan their finances better. Comparing lenders and using tools like a gold loan interest calculator ensures transparency and helps in making informed decisions.

A gold loan is a convenient solution for immediate financial needs. By assessing costs carefully, you can ensure that it serves as a reliable and affordable borrowing option.