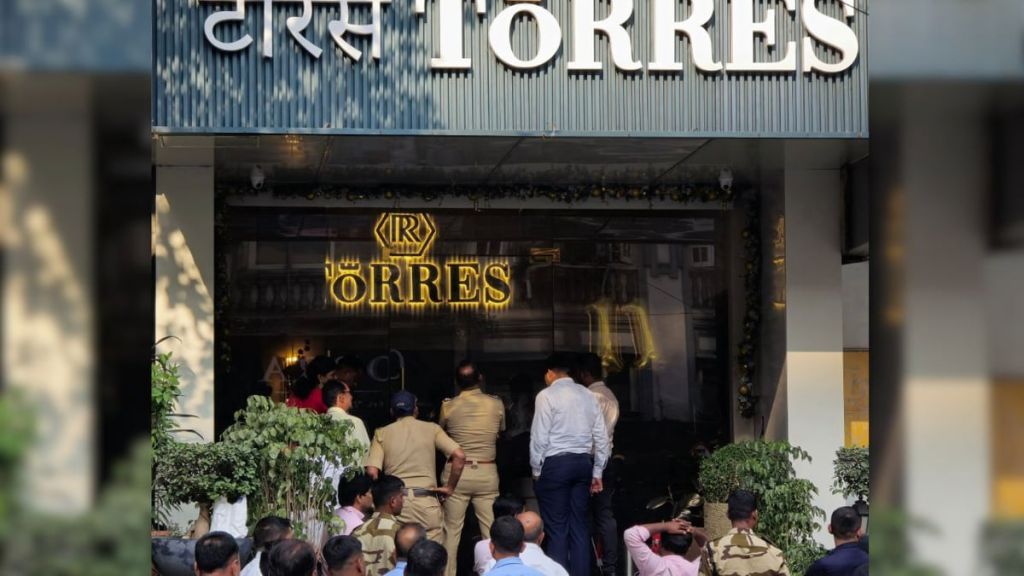

In the early hours of January 6, the Shivaji Park Police sealed the Torres showroom on J.K. Sawant Marg, opposite Shivaji Mandir in Dadar, and disrupted an ongoing meeting based on a tip-off about an impending financial scam, which has ballooned into a Rs 1,000 crore fraud. The police, acting on information from a showroom employee, learned that the company was planning to shut down after defrauding investors. Senior Inspector Yuvraj Sarnobat led the operation at around 1 a.m., sealing the premises and recording statements of attendees before arresting General Manager Tania Kasatova (an Uzbek national), Director Sarvesh Ashok Surve, and Store Manager Valentina Ganesh Kumar, an Indian-Russian citizen. The trio was allegedly preparing to flee with cash and jewellery from the showroom.

The primary suspects, founder Mohammad Tausif Riyaz, alias Jorn Carter (33), and Victoria Kovalenko (38), both Ukrainian nationals, have reportedly fled the country. A Look-Out Circular (LOC) was issued against them, but they had disappeared before that.

Strangely, it was vegetable vendor Pradeep Kumar Vaishya (31) who truly got the police to act against Torres. The Torres showroom opened in February last year, right across from Vaishya’s stall. The company's modus operandi was to accept deposits from the public with the promise of a six per cent interest per week. Investors were given diamonds and jewellery as security for their deposits. Believing their investments were well-secured, thousands of people poured money into the company, little realizing that the diamonds and jewellery were either fake or of highly impure quality. The scheme was promoted through a multi-level marketing strategy, where people convinced others through word-of-mouth to invest. Vaishya, initially convinced by timely payouts, invested Rs 4.55 crore by raising funds through mortgaging his properties and borrowing from relatives and friends. Many reinvested their returns for higher profits. However, the interest payouts stopped suddenly in December, which was when the investors became suspicious.

Vaishya told The Free Press Journal on Friday that he was placed in a highly embarrassing situation since several vendors had also invested with the company after trusting his advice. Vaishya was alerted by showroom supervisor Abrar Sheikh at 2 a.m. on January 6, who informed him about the company’s plans to permanently shut down operations. There was also a message to that effect in the Torres employees' internal Telegram group. Shocked, Vaishya lodged a complaint with Shivaji Park Police the same morning, leading to the registration of an FIR under the Maharashtra Protection of Interest of Depositors (MPID) Act.

After the registration of this FIR, all hell broke loose, and over 1,000 people lodged complaints with the Shivaji Park police station and the Economic Offences Wing (EOW) of the Mumbai crime branch, which has taken over the investigation. A special cell has also been set up at Shivaji Park Police Station to assist victims in registering their grievances. Investors are being asked to fill out a detailed three-page form.

By January 6, Torres had shut down online transactions, accepting only cash while promising higher commissions. Police investigations revealed that Director Sarvesh Surve, a former Aadhaar operator hired at ₹22,000 per month, used his identity to establish the company. Surve was arrested from Dongri. Police suspect that Torres operated similar scams abroad. Three bank accounts have been frozen, holding crores in funds.

Interestingly, Abhishek Gupta, the chief accountant of Torres, had played the role of a whistleblower and sent emails to the police, ED, and other agencies a couple of months ago alerting them about the fraud. However, none of the agencies acted on his information. A special cybercrime team is probing this angle.

Starting from December 29, Torres investors began missing their promised weekly returns. When they inquired, the company assured them that two pending installments would be paid together soon. However, even those payments never arrived. By January 6, crowds of frustrated investors gathered at Torres showrooms in Dadar and other places, only to discover that the main suspects had disappeared.

Surprisingly, Mumbai Police had received preliminary reports of fraudulent activity at Torres as early as June, while Navi Mumbai Police was alerted in October. Despite these warnings, no action was initiated, raising serious questions about the reason for the inaction.

The scam’s lure began with a synthetic diamond-like stone called moissanite, handed to investors for every ₹1 lakh invested. Promised weekly returns of 6% (₹6,000 per lakh) over 52 weeks, investors were drawn in with the allure of steady profits. As trust grew, they were incentivized with referral bonuses of 5% to 10% for bringing in new investors.

During Christmas and New Year promotions, commissions were increased to 15% or even 20%—but only for cash investments. Seeing large sums credited to their accounts and visually appealing profit figures boosted investors' confidence further. This led many to reinvest their earnings, increasing their stakes exponentially.

Referral schemes ballooned Torres' reach. Individual investors built extensive networks, linking 20 to over 100 new participants under them. The cycle of aggressive recruiting, high returns, and referral bonuses created a vast, unsustainable pyramid. When the payouts stopped, the entire structure collapsed, leaving thousands of victims grappling with financial ruin.