Honasa Consumer, which operates the personal care product brand called MamaEarth; the shares of the parent company Honasa Consumer took another nosedive of 18.46 per cent after hitting a 20 per cent lower circuit level in previous trading session, reacting on the net loss recorded in Q2 FY25.

The stock went straight to touch the record low level of Rs 242.35 per share on the NSE (National Stock Exchange), after the opening bell at Rs 254.95 per share on the bourses with dive of 14.23 per cent at the opening bell level.

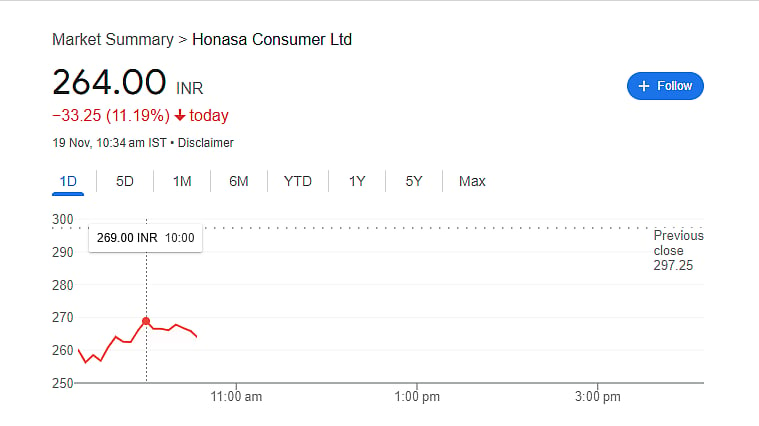

The stock was currently trading at Rs 264.00 per share on the NSE (National Stock Exchange), with a decline of 11.19 per cent amounting to a Rs 33.25 per share on the Indian bourses.

IPO and listing price

Currently, the share price is less than the initial public offering. On November 7, 2023, Honasa Consumer Ltd.'s shares went public at a 2 per cent premium, or Rs 324, over the issue price of Rs 330 per unit. The company has a market value of Rs 9,655.39 crore.

Honasa Consumer Q2 FY25

Net profit/loss

For the second quarter of the fiscal year 2024-2025, Honasa Consumer reported a consolidated loss of Rs 18.57 crore as a result of inventory correction. The company's net profit for the same period last year was Rs 29.43 crore.

Q2 FY25 EBITDA and revenue

Revenue from operations dropped 6.9 per cent to Rs 461.82 crore in the reviewed quarter from Rs 496.1 crore in the same period last year.

The company's earnings statement showed a 6.6 per cent decrease in earnings before interest, taxes, depreciation, and amortisation (EBITDA) margin in Q2 FY25, with the EBITDA margin adjusted for inventory correction at 4.1 per cent.

Total expense Q2 FY25

The total expenses of Honasa Consumer climbed by 9.1 per cent to Rs 506.21 crore compared to the September quarter of FY24. At Rs 481.84 crore, the overall revenue dropped 4.24 per cent.