Malé: Maldives President Mohamed Muizzu opted to implement the Unified Payment Interface (UPI) in the country following the Cabinet's recommendation. Digital payment systems in India, such as the Unified Payments Interface (UPI), are increasingly gaining international appeal due to efforts to facilitate smooth cross-border transactions. This is reducing the expense of transferring funds and making remittance payments.

Countries like Singapore, Malaysia, the UAE, France, Nepal, the UK, Mauritius, and Sri Lanka are among the foreign markets that are now allowing UPI payments. This action was taken after India agreed to collaborate on digital and financial services and to assist in the development of Digital Public Infrastructure (DPI) by introducing India's Unified Payments Interface (UPI) and Unique Digital Identity during Muizzu's State Visit earlier this month.

According to a statement from his office, the Maldivian President's decision is anticipated to have substantial advantages for the Maldivian economy, such as higher financial inclusion, better efficiency in financial transactions, and enhanced digital infrastructure.

President Dr Mohamed Muizzu, on the recommendation of the Cabinet, has decided to take the necessary steps to introduce India’s Unified Payment Interface (UPI) in the Maldives.

— MV+ (@mvplusmedia) October 21, 2024

Read more: https://t.co/DDCEjZ1ksnhttps://t.co/DDCEjZ1ksn

The announcement also mentioned that the choice was reached following a comprehensive discussion of a report presented by the Minister of Economic Development and Trade during a cabinet session. President Muizzu also made the choice to establish a collaboration to launch UPI in the Maldives and proposed that banks, telecom companies, state-owned companies, and fintech companies in the country should all be involved in the collaboration.

Muizzu also designated TradeNet Maldives Corporation Limited, a top agency with demonstrated skills, as the consortium's leading agency, as per the statement. He also chose to form a team for interagency coordination involving the Ministry of Finance, Ministry of Homeland Security and Technology, and the Maldives Monetary Authority to supervise the establishment of the UPI in the Maldives under the Ministry of Economic Development and Trade.

While visiting India earlier this month, India introduced RuPay cards in the Maldives to facilitate payments for Indian tourists in the Maldives and Maldivian nationals in India, aiming to strengthen digital and financial collaboration between the two nations.

Countries such as Greece, Sri Lanka, and Mauritius, as well as UAE, France, Singapore, Nepal, Malaysia, Oman, UK, Europe, Bhutan, and Bahrain utilize UPI.

India's Objective with UPI

During the G20 digital economy working group meeting in Lucknow, Union Minister Ashwini Vaishnaw announced on February 13, 2023, that India has entered into MoUs with 13 countries interested in adopting the UPI interface for digital payments, with Singapore already having completed its UPI integration.

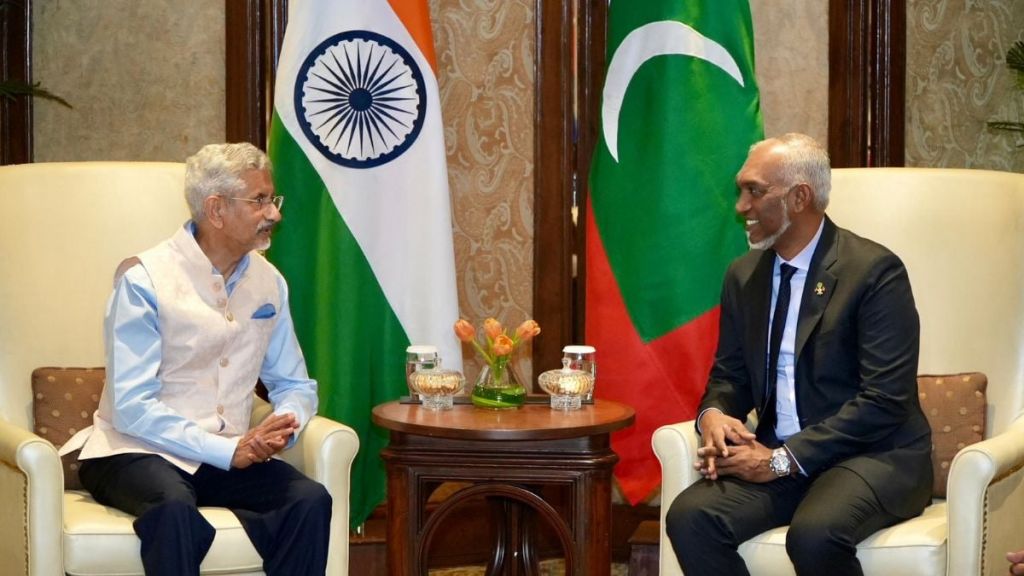

The MOU signed by External Affairs Minister S. Jaishankar in August during his visit to the Maldives paved the way for the implementation of the Unified Payments Interface (UPI) across the Indian Ocean archipelago, aiming to enhance tourism.

The MoU signed between the Ministry of Economic Development & the National Payments Corporation of India (NPCI) aims for a more inclusive & efficient financial ecosystem that benefits all Maldivians—a significant step in economic collaboration between Maldives & India pic.twitter.com/jJefjAnuiT

— Ministry of Foreign Affairs (@MoFAmv) August 10, 2024

Jaishankar and Moosa Zameer concluded their meeting by signing an MoU between the NPCI and the Maldives’ Economic Development and Trade Ministry on the digital payment system.

Good News For Indian Tourists And NRIs

As NPCI International Payments Limited (NIPL) establishes alliances with various countries, global partnerships are being formed to create a vast acceptance network for RuPay and UPI. Indian tourists can now use these payment methods while travelling abroad. In April 2020, NIPL was established as a fully owned subsidiary of NPCI to focus on the global expansion of RuPay and UPI.

Additionally, India has stated that NRIs in 10 foreign countries who have Indian bank accounts linked to foreign mobile numbers, as well as foreign travellers arriving in India, will have UPI access at select international airports as part of its efforts to boost the digital economy. India is presently engaged in discussions with Russia and Thailand regarding the utilization of RuPay and Mir cards, as well as the interaction and connection between UPI-FPS and the linkage between UPI and Prompt Pay Service.